Frequently Asked Questions

What are these education bonds, and how will the money be used?

There are two bonds on the March 3rd ballot. The Iredell County School Bond is a K-12 education bond for Iredell-Statesville School District and Mooresville Graded School District to address current school overcrowding, and growth that continues to exacerbate the problem. The total cost of this bond is $115 million. The Iredell County Community College Bond is for Mitchell Community College to address the growing demand for additional public safety and emergency services training, and has a total cost of $10 million.

Iredell County School Bond: Both Iredell Statesville Schools and Mooresville Graded School districts are experiencing significant overcrowding of existing school buildings, specifically at Lake Norman and South Iredell High Schools (ISS) and Mooresville Middle School (MGSD).

- Lake Norman High School is poorly located, and the structure has been expanded to the maximum size allowable on the site. LNHS is currently 400 students above maximum capacity.

- South Iredell High School is currently 400 students above maximum capacity.

- Mooresville Middle School, the only county Middle School that serves only 7th and 8th grade (rather than 6th, 7th and 8th grades) is currently 150 seats over capacity.

ISS proposes using $80 million in bond funding to build a new high school in the Southern part of the county creating capacity for 1,600 students. This will alleviate overcrowding from both Lake Norman and South Iredell High Schools.

MGSD proposes using $35 million in bond funding to build a new middle school off of Rhinehart Road in Mooresville, which will add 900 seats and will alleviate the overcrowding at the current Mooresville Middle School. MGSD is also at capacity at all three elementary schools (including mobile units) however, rather than request funding to build a fourth elementary school as well, the district has taken a strategic look at capacity across all Kindergarten through 6th grade schools. In order to solve the overcrowding issues at all schools, MGSD will reconfigure grades in the three existing elementary schools and two intermediate schools—the elementary schools will become grades K-2 (currently K-3), the intermediate schools will become grades 3-5 (currently 4-6). 6th grade will be moved from the intermediate schools, to the existing Mooresville Middle School, and the new middle school, following the more traditional middle school model of grades 6-8.

Iredell County Community College Bond: Mitchell Community College proposes using $10 million to building a new Public Safety Training Center and driving pad to support the expanding need for quality public safety and emergency services personnel.

Who determined the projects included in this education bond?

The Iredell County Education Facilities Task Force was established in 2011 to evaluate the long-term needs of all K-12 schools in both districts, as well as Mitchell Community College. The Task Force consists of Iredell County Commissioners, members of the boards of education, school district personnel, community leaders and structural engineers. Over the next three years, the Task Force conducted extensive investigations and studies to identify the areas of most critical concern to both districts, and developed a ten-year plan to address these needs, culminating in a bond which passed with solid voter support in 2014.

In 2017, the Task Force reconvened to reevaluate the remaining projects from the ten-year plan, and of course to adapt it to the changing needs of our growing communities. As growth in the Southern end of Iredell County has exceeded the rest of the county, overcrowding of Lake Norman and South Iredell High Schools and Mooresville Middle School have reached levels that can no longer be ignored or deferred.

The Task Force compiled the project lists for both 2014 and 2020 bonds based on giving priority to facilities with the most urgent need, as well as safety and environmental concerns and the future academic needs of our students. This approach complies with statutes requiring that such projects be prioritized based on need, as well as statutes requiring counties to provide safe adequate school facilities that meet the educational needs of our children.

Why can't schools just use their massive budgets or save the money to pay for these buildings?

Actually, not only do our schools not have big budgets (when you consider the number of students that are educated) but NC ranks 45th out of 51 states (including the District of Columbia) for per pupil spending. Further, out of the 115 school districts in NC, ISS ranks 113th and MGSD ranks 96th in per pupil spending. So the bottom line is, our schools in Iredell County are funded at the lowest level in the entire United States. It’s also important to note that school budgets are for operating expenses, including routine repairs and maintenance, not capital construction projects.

School construction is extremely expensive and varies by type of school (elementary, middle or high school), and it also varies widely based on land cost. Regardless, even if the school budgets included enough extra money to save for capital projects, it would take many decades just to save enough to build one school. It’s the same principal that applies to borrowing money to build a new house—how many people build or purchase a new house with cash that they have saved? Issuing bonds is standard practice to fund school construction in the United States, just as taking out a mortgage is standard practice to buy a house.

Don't schools get lottery funding to build facilities? What did they do with all that money?

There has been a lot of confusion about the North Carolina Education Lottery—the fact is, less than 30% of all lottery revenue goes to support education. In 2018, the Lottery gave just under $10.5 million to Iredell County, which is split into several buckets: 1) Pre-Kindergarten for at risk children, 2) College Scholarships for qualifying students in the NC state or community college system, 3) Financial Aid—grants to UNC college students who qualify for need-based financial aid, 4) School Construction Projects, 5) Non-Instructional Support and 6) Transportation.

It’s important to note that several years ago the General Assembly changed the legislation allowing the state to allocate Lottery funds for “education-related” expenses rather than school construction (as was specified in prior legislation). So funds which had once been available for school construction only, can now be used, at our legislators’ discretion, to supplement items that have been cut or reduced from the State’s regular education expense budget—over the last several years, Lottery funds have been redirected from school construction to subsidize the cost of non-instructional support and transportation, traditionally standard budget line items.

Mitchell Community College is not eligible for any lottery funds for construction.

In Fiscal Year 2018-2019, Iredell County received a total of $1.8 million in Lottery funds for school construction, of which only $1.4 million was allocated for ISS and $400,000 for MGSD. If the districts were able to save all the lottery money, and with zero inflation, zero increase in cost of construction and no change in the value of today’s dollars versus tomorrow’s dollars, it would take 88 years to save enough to build a new middle school for MGSD and 57 years to build a new high school for ISS.

Why can't developers just pay for schools, since they're causing the problem?

Commissioners can not prevent property owners from selling their land to developers. Over the years, we’ve seen property owners cash in by selling hundreds of acres of former farmland to developers who build big housing developments, which in turn put a strain on our roads, infrastructure, and for sure, our schools.

What so many do not realize though is that back in the 1980s, the NC General Assembly passed legislation that prohibits local governments from charging “impact fees” to developers as a condition for developing land. An impact fee is a fee imposed by local government on a new or proposed development to pay for all or a portion of the costs of providing public services to the new development. While it sounds completely reasonable to expect that developers, who make a lot of money from all the homes they sell, should pay an impact fee, the state of North Carolina prohibits this practice. So while it would be great if developers would pay for part of building new schools, by law they can not be required to do so.

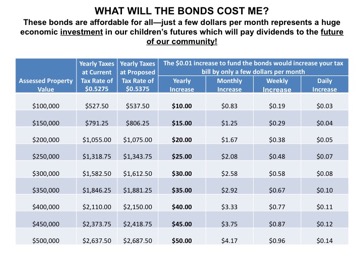

What will these bonds cost me?

That depends. Ultimately, the Iredell County Commissioners will be the ones to decide how we will pay for these bonds. Just remember, voters are voting for the bonds only, not a tax increase. Should the commissioners decide to fund these bonds entirely through property taxes, the tax rate would increase by $0.01 (1 cent per $100 of assessed value). However, it is important to note that this increase is based on Iredell County’s economics today, and doesn’t take into account any economic growth between now and the time the money is needed. In other words, if no new business and no new taxpayers come into the county over that time period the tax rate would rise by at most, 1 cent. Any economic growth during that time period will also grow the tax base and could offset potential property tax increases proportionally.

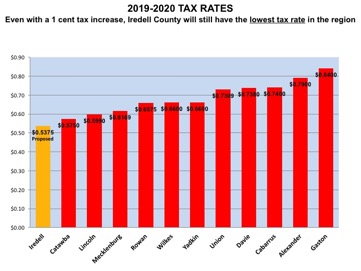

It is also worth noting that Iredell County’s current tax rate is significantly lower than all the neighboring counties in the region. If the commissioners do raise taxes by the $0.01 (the full amount needed to pay for the bonds) the new tax rate would be $0.5375, which is still lower than all other counties in the region. So, even after investing in our community, Iredell County would still enjoy the lowest tax rates in the region.

To put this in perspective, a family with a home valued at $150,000 could see a tax increase of about $15 per year or 29 cents per week—Not only are these bonds a great investment, they are very affordable!

Why are good schools so important?

Quality schools are critical to the health of our community. There is a direct correlation between the quality of our schools and economic growth and development, crime rate, and overall quality of life. Good schools attract new businesses and incent existing businesses to expand. Not only do employers use our schools as a “selling point” for recruiting employees, but good schools provide a qualified labor force to fill jobs locally. Local employees further help grow the local economy by spending locally (shops, restaurants, entertainment), and the cycle continues.

Community colleges train healthcare, public safety and emergency services personnel (police, fire and emergency medical responders) who provide critical services countywide, keeping our communities healthier and safer and benefitting all citizens, young and old.

Quality schools provide students with direction, and a path to the future by focusing on the importance of graduating and pursuing higher education or vocational training. Students who are encouraged to stay in school, who feel vested in their education and work toward graduation are less likely to commit crimes. They are four times less likely to become part of the prison population, so good schools lead to lower crime rates and fewer inmates in our jails!

But I don't even have kids in school. How will these facilities help me?

Quality schools aren’t only important to students and their families, they are vital to our economy. Economic development matters to everyone in our community, regardless of whether or not one has kids in school. A growing economy grows the commercial tax base, thereby reducing the tax burden of individual property owners. In order to provide services to residents, the costs of which continue to grow, counties with a shrinking or stagnant commercial tax base must pass along the additional cost to property owners, or must reduce the services provided.

All these factors, which are directly tied to the quality of schools in our community lead to increased property values, and this affects everyone, regardless of whether or not you have children in our schools. Ask any real estate professional and they will tell you good schools are key to growing your property values!

Furthermore, the education bond for Mitchell Community College supports a critical public safety training facility. Mitchell trains or certifies the majority of our community's law enforcement, paramedic, and fire professionals--meaning that this facility benefits the important and life-saving professionals who answer your calls for help. Everyone in our county will benefit from having public safety professionals whose training facility was greatly improved.

Who in our community supports the education bonds?

The 2020 Education Bonds have significant non-partisan support throughout the county. The Our Schools First referendum committee is funded entirely by financial contributions from local businesses and organizations that recognize just how critical quality schools are to the local community and economy. In addition to financial support from the business community, the education bonds have the support of:

- Mooresville Graded School District Board of Education

- Iredell Statesville School District Board of Education

- Iredell County Commissioners

- Mooresville Mayor Miles Atkins

- Town of Mooresville Board of Commissioners

In addition, thousands of tax-payers, parents and non-parents alike, who share a passion for education, also support these bonds. Rather than seeing the bonds as a tax increase, they see an opportunity to invest in our kids, our schools, our communities and our futures.

Why did my taxes increase in 2019?

In 2019, the Iredell County Assessor’s Office conducted a reappraisal of all real property in the county, as required by North Carolina General Statutes. Iredell County reappraises real property every four years, and the goal is to equalize the tax burden to all property owners across all property types. Real property is appraised at the current market value, and taxes are assessed accordingly. It is important to note that while property taxes for many did increase due to reappraisal, so did market values, so while your overall tax bill may have increased, the good news is that tax rates stayed the same--the value of your house increased by far more.

Remember, this reappraisal was conducted for all real property, so commercial property values increased as well, as did the taxes paid by businesses. Iredell County is a strong and growing county which is very popular with businesses—they bear a larger property tax burden than homeowners, which subsidizes the residential tax burden. Home owners in counties with little or no commercial tax base, tend to pay much higher property taxes because the businesses are not there to keep taxes low.

What happens if the education bonds fail?

The fact is that our schools are already overcrowded and growth is continuing—students are already here and more are coming. If the bonds fail, there are limited options available to provide facilities for these students. Portable “mega units” will be installed on our current campuses to house the overflow of students. Mega units are similar to large trailers which provide approximately eight classrooms each, however they are very costly. At a minimum, each mega unit costs over $500,000 to setup and install, and unlike traditional construction, the value of mega units decreases each year, rather than appreciates. Further, mega units are maintenance intensive, putting additional strains on operating budgets.

Many of our campuses already use mega units, however in the southern end of the county, our options are even more limited. For example, Lake Norman High School can not install any additional structures on the property footprint, so that is not an option for that school. The only other option in this case would be to move some students to other Iredell County high schools that have extra capacity, or have the property to install another mega unit. However, that means that students will attend schools far from where they live, requiring the school districts to purchase additional buses, increase spending on fuel and maintenance, and hire additional bus drivers to transport these students to and from school—and these costs are significant.

Further, as safety and security are always a main concern for every school district in America, mega units present another challenge—teachers and students in mega units are separated from the main building, creating a security vulnerability.

The bottom line is that one way or another, we will all have to pay for facilities for our students. The questions are, do we pay for them for a finite period of time through a bond that funds building new quality facilities? Or do we pay for substandard temporary facilities that lose their value, must be replaced long before “brick and mortar” buildings, create security vulnerabilities, and require additional personnel and transportation expenditures?

What can I do to help?

YOU MUST VOTE AND VOTE YES! Election day is Tuesday March 3rd 2020, but you can vote early starting on February 13th! Remember these important dates and deadlines:

- January 13—Absentee voting by mail begins

- February 7—Voter registration deadline (no same day registration)

- February 13—Early voting begins (select locations)

- February 25—Last day to request absentee ballot by mail (by 5:00 pm)

- February 29—Early voting ends

- March 3—Last day to return absentee ballot by mail (by 5:00 pm)

- March 3—Election Day (6:30 am – 7:30 pm)

For further information, to check your registration status, find your polling place or request an absentee ballot, check out the NC Board of Elections Website at www.ncsbe.gov/ncsbe/ or Iredell County’s website at https://www.co.iredell.nc.us/1342/2020-Election-Information

How can we be sure bond money will only be spent on bond projects?

Funds from school bonds can only be used for capital expenses (new construction or renovations), the funds cannot be used to pay regular recurring expenses, salaries or other operating expenses. Because a new school building provides a benefit and will be used over many decades, the capital expenses incurred during construction are also spread over a long period of time (usually 20 years). Salaries, recurring and other expenses cannot be capitalized over many years because they provide benefit only when the expenses are actually incurred.

All school districts in North Carolina are audited annually by an outside, independent accounting firm, to ensure that districts are in compliance with State regulations (public education is highly regulated), as well as accepted accounting principles. The annual audit reviews all expenses--regular operating expenses, recurring expenses and capital expenses, and ensures that school districts spend funds allocated to the different “buckets” properly. School districts must release audit results to the public every year. Both ISS and MGSD have received excellent audit reviews for the past fifteen years.